Guide to Audit Exemption

New Criteria for Audit Exemption (w.e.f. 1 July 2015)

Previous Audit Exemption Criteria (before 1 July 2015)

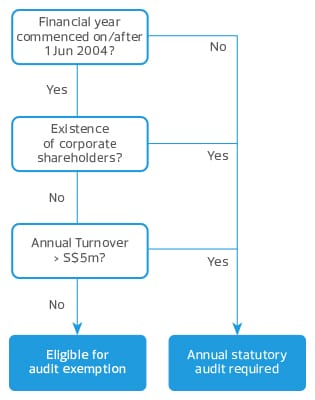

A company incorporated under the Singapore Companies Act is subject to statutory audit in Singapore unless it meets the audit exemption criteria. Before 1 July 2015, Exempt Private Companies* (EPCs) with annual revenue of less than S$5 million are not required to have their accounts audited for financial year beginning on or after 1 June 2004.

*An EPC is a private limited company with no corporate shareholders and no more than 20 shareholders.

Previous Audit Exemption Criteria

(before 1 July 2015)

New Audit Exemption Criteria (from 1 July 2015)

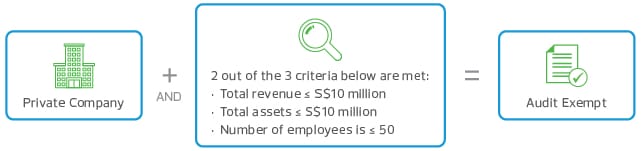

With the recent amendments to the Singapore Companies Act, a private company that used to require statutory audit may no longer need to do so. The revised audit exemption criteria introduces the concept of “small company” and “small group” classifications in determining if a company/group qualifies for audit exemption for a particular financial year (FY). The previous audit exemption criteria (before FY starting 1 July 2015) for EPCs no longer applies once the revised audit exemption criteria takes effect.

The revised criterion stipulates that a company qualifies as a small company and is exempted from statutory audit if it meets the following:

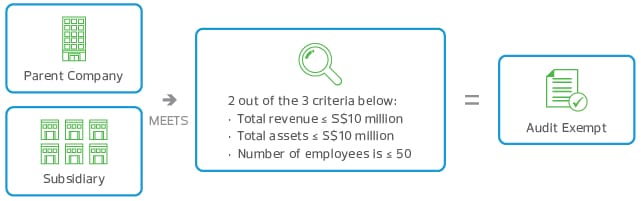

A small group is one that meets at least 2 out of the 3 quantitative criteria mentioned above on a consolidated basis for the last two consecutive financial years.

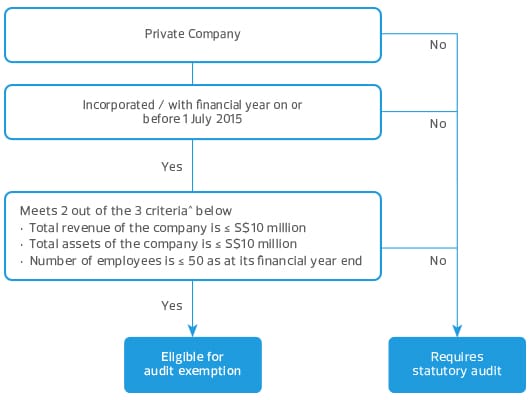

To find out if your company qualifies for audit exemption, check the flowchart below:

New Audit Exemption Criteria

(from 1 July 2015)

^Either in the first or second financial year commencing on or after 1 July 2015.

If your company qualifies for audit exemption, contact us to assist you with the Drafting of Unaudited Financial Statements so that you can meet your annual filing requirements with ACRA & IRAS.

If your company require statutory audit, contact us to assist you with the Drafting of Financial Statements for audit review.