What is Goods and Services Tax (GST)?

GST is a consumption tax that is imposed on the import of goods as well as nearly all supplies of goods and services in Singapore. Supplies that are GST exempt include the provision of most financial services, sale and lease of residential properties, importation and local supply of investment precious metals. Supplies that are zero-rated include export of goods or international services.

| Type |

Rate |

| Standard-rated |

7% |

| Zero-rated |

0% |

| Exempt |

0% |

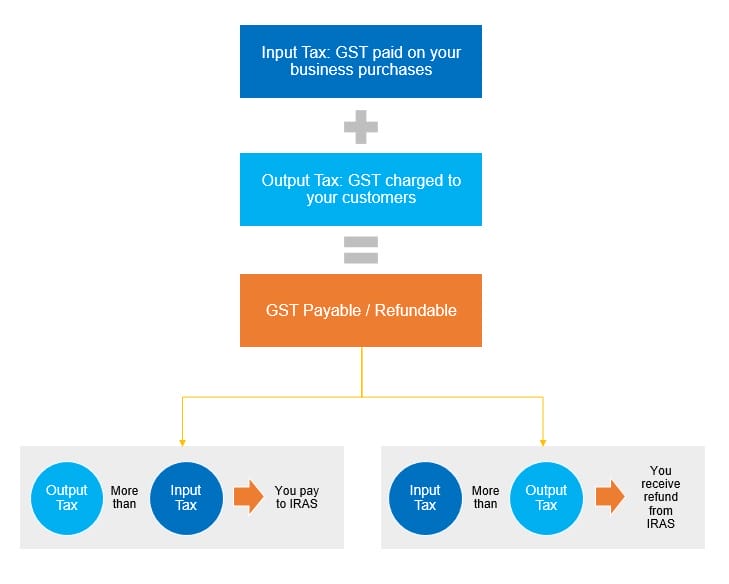

A business can charge and collect GST (accountable as output tax) only if it is GST registered and can claim GST incurred on business purchases (input tax) subject to certain conditions.

When does your business need to register for GST?

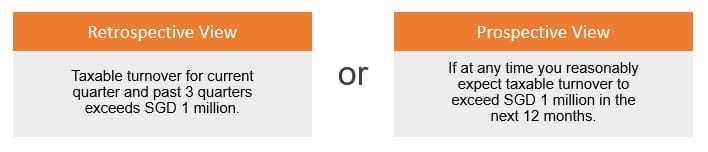

It is mandatory for businesses with taxable turnover or expected taxable turnover exceeding S$1 million to register for GST. However, if you wholly or mainly export goods or provide international services, you may apply for exemption from this requirement. Businesses can rely on the retrospective or prospective view when they determine their liability for GST registration.

Voluntary registration of GST is possible. However, this is subject to IRAS’ approval and there may be a need for the business to complete two e-learning courses and register for GIRO payment/refund of GST. The business must also remain GST registered for at least 2 years and a security deposit may be required.

How does registering for GST help your business?

After your business is GST registered, it can claim GST incurred on imports and business purchases (input tax), subject to certain conditions. Your business must commence the charging of GST with effect from the date it is GST registered.

How to file GST returns?

Most GST registered businesses file their GST returns quarterly. Even if the business does not have any transactions during the accounting period, a nil return must be filed. You should generally report the business’ taxable supplies, exempt supplies, taxable purchases, imports, output tax, input tax and revenue in your GST return. The difference between the output tax and input tax is the net GST payable to IRAS or refundable by IRAS.

How does Xero help with your GST reporting?

Application of default tax rates

Once you have selected Singapore as your organisation’s country in Xero, the local default tax rates will be automatically loaded and you can assign the appropriate GST codes to the transactions you are recording. Additionally, Xero will also apply the correct codes to your IRAS audit file based on the tax rates selected.

Invoice in foreign currencies

If your base currency is in Singapore Dollars and you need to invoice customers in foreign currencies, Xero includes a custom invoice template that features a separate table covering GST details that helps with reporting.

GST F5 completion made easy

Xero allows you to generate the sales tax report, simplifying the process of completing your GST F5 return.

Need help with accounting and GST?

We provide accounting services & advisory, help business get started with Xero as well as advise them on GST compliance matters. Contact us at info@Accountserve.com.sg or +65 6594 7790/7681.

References:

https://www.iras.gov.sg/IRASHome/GST/Non-GST-registered-businesses/Learning-the-basics/How-GST-Works/

https://www.iras.gov.sg/irashome/GST/GST-registered-businesses/Working-out-your-taxes/Can-I-claim-GST/Conditions-for-Claiming-Input-Tax/

https://www.iras.gov.sg/IRASHome/uploadedFiles/IRASHome/e-Tax_Guides/etaxguides_GST_Exports_2013-12-31.pdf

https://help.xero.com/int/SingaporeGST