GST-registered traders are required to issue tax invoices for standard-rated supplies with total amount payable (including GST) exceeding S$1,0001. A tax invoice is the main document that GST-registered entities relies on to support their input tax claim. Generally, a tax invoice should be issued within 30 days from the time of supply.

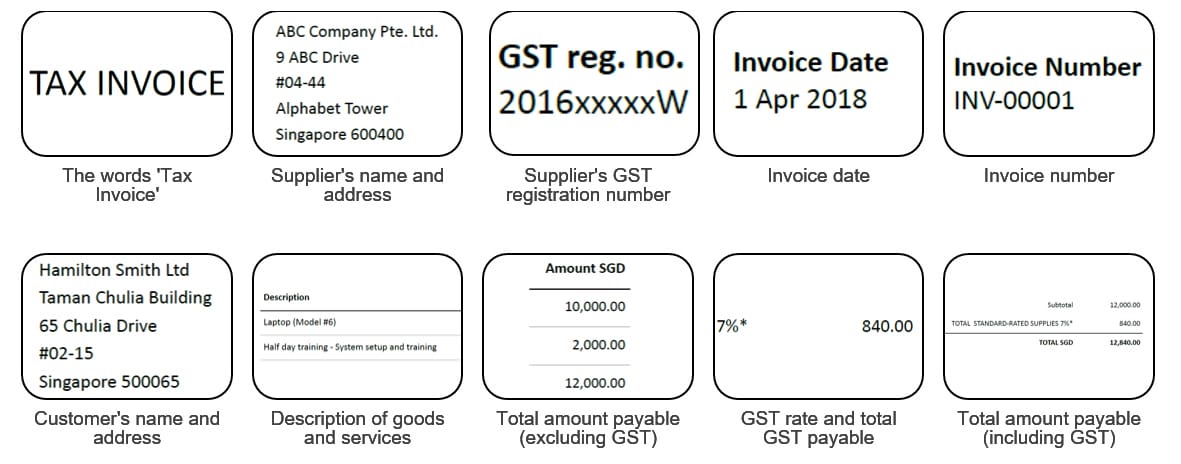

Here are some of the information required on a Singapore-dollar denominated tax invoice:

Common errors when preparing tax invoices2

- Supplier’s name, address and GST registration number are not shown

- The supplier’s GST registration number is invalid and not found in the Register of GST-registered Businesses

- The words “Tax Invoice” are not shown

- For amounts over S$1,000:

- Customer’s name is not indicated on the tax invoice

- Tax invoice does not show GST amount separately

Cloud accounting software can help reduce errors and improve compliance

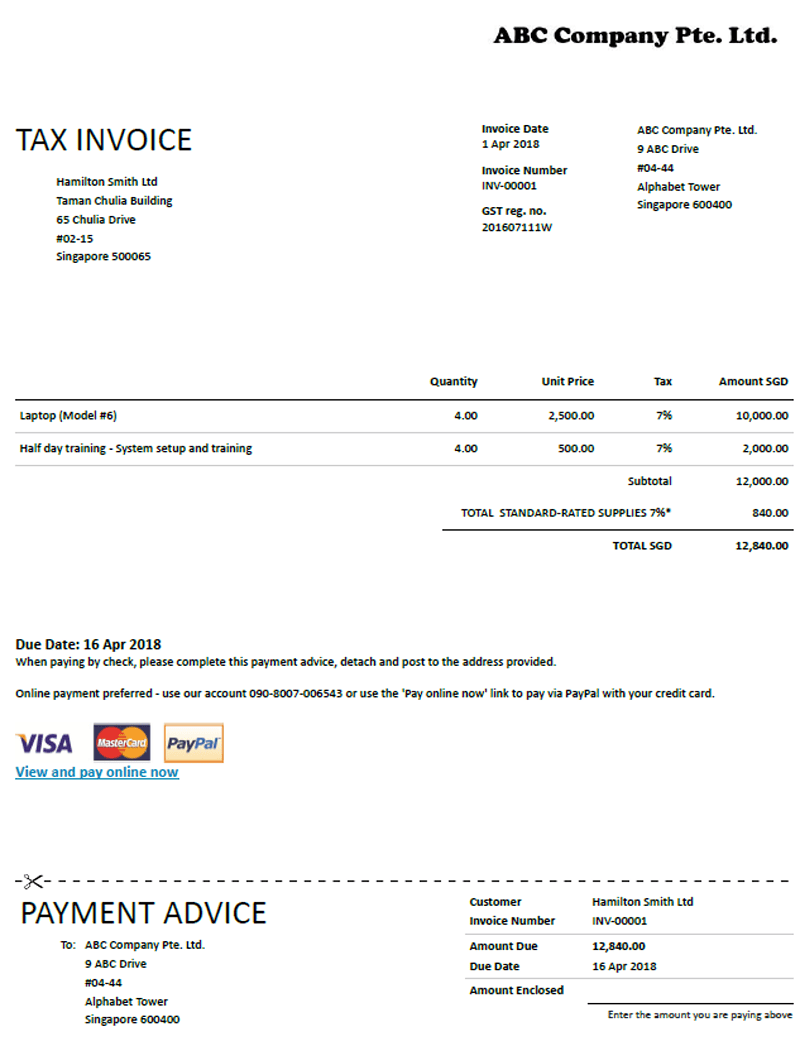

These errors can be easily avoided by using Xero, an IRAS-approved accounting software.

Xero’s invoicing tool allows users to set up invoice templates which conform to IRAS requirements. This greatly reduces human and clerical errors when preparing tax invoices.

Built-in features that minimise errors include:

- Pre-set invoice header that shows 'Tax Invoice'

- Company's name, address and GST registration number are extracted from the main setting and automatically shown on the invoice

- Invoice date is a mandatory field before system allows the invoice to be issued

- Invoice numbers are generated by Xero and every invoice is assigned an invoice number

- Customer's name and address are managed by Xero, allowing businesses to update their customer information in a timely manner

- Description of goods and services can be pre-set as a sales item in Xero, allowing for consistent description for invoices

- Total amount payable excluding GST and total amount payable including GST are automatically calculated by Xero

- System automatically uses default tax rates that are prescribed by IRAS

- Generation of tax reports and listings to facilitate GST submission to IRAS

An example of an invoice generated using Xero:

Contact us

Contact us to discover how you can improve your GST compliance and enjoy the benefits of cloud accounting.