Page 21 - Doing Business in China

P. 21

FOREIGN EXCHANGE CONTROLS

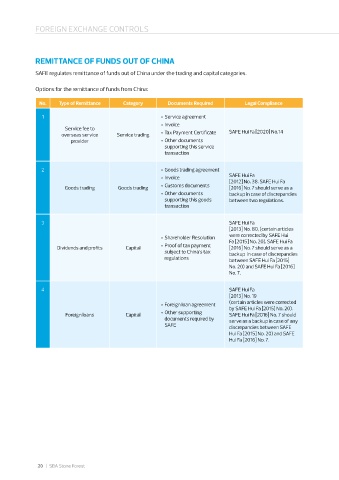

REMITTANCE OF FUNDS OUT OF CHINA

SAFE regulates remittance of funds out of China under the trading and capital categories�

Options for the remittance of funds from China:

No. Type of Remittance Category Documents Required Legal Compliance

1 • Service agreement

• Invoice

Service fee to SAFE Hui Fa [2020] No�14

overseas service Service trading • Tax Payment Certificate

provider • Other documents

supporting this service

transaction

2 • Goods trading agreement

• Invoice SAFE Hui Fa

[2012] No� 38� SAFE Hui Fa

Goods trading Goods trading • Customs documents [2016] No� 7 should serve as a

• Other documents backup in case of discrepancies

supporting this goods between two regulations�

transaction

3 SAFE Hui Fa

[2013] No� 80, (certain articles

• Shareholder Resolution were corrected by SAFE Hui

Fa [2015] No� 20)� SAFE Hui Fa

Dividends and profits Capital • Proof of tax payment [2016] No� 7 should serve as a

subject to China’s tax backup in case of discrepancies

regulations between SAFE Hui Fa [2015]

No� 20) and SAFE Hui Fa [2016]

No� 7�

4 SAFE Hui Fa

[2013] No� 19

• Foreign loan agreement (certain articles were corrected

by SAFE Hui Fa [2015] No� 20)�

Foreign loans Capital • Other supporting SAFE Hui Fa [2016] No� 7 should

documents required by serve as a backup in case of any

SAFE discrepancies between SAFE

Hui Fa [2015] No� 20) and SAFE

Hui Fa [2016] No� 7�

20

20 | SBA Stone Forest