Page 24 - Doing Business in China

P. 24

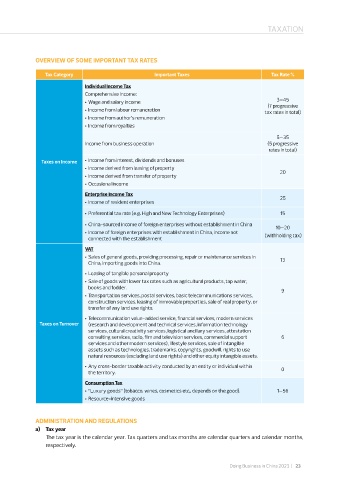

TAXATION

OVERVIEW OF SOME IMPORTANT TAX RATES

Tax Category Important Taxes Tax Rate %

Individual Income Tax

Comprehensive Income:

3–45

• Wage and salary income (7 progressive

• Income from labour remuneration tax rates in total)

• Income from author’s remuneration

• Income from royalties

5–35

Income from business operation (5 progressive

rates in total)

Taxes on Income • Income from interest, dividends and bonuses

• Income derived from leasing of property 20

• Income derived from transfer of property

• Occasional income

Enterprise Income Tax 25

• Income of resident enterprises

• Preferential tax rate (e�g� High and New Technology Enterprises) 15

• China-sourced income of foreign enterprises without establishment in China 10–20

• Income of foreign enterprises with establishment in China, income not (withholding tax)

connected with the establishment

VAT

• Sales of general goods, providing processing, repair or maintenance services in 13

China, importing goods into China�

• Leasing of tangible personal property

• Sale of goods with lower tax rates such as agricultural products, tap water,

books and fodder�

9

• Transportation services, postal services, basic telecommunications services,

construction services, leasing of immovable properties, sale of real property, or

transfer of any land use rights�

• Telecommunication value-added service, financial services, modern services

Taxes on Turnover (research and development and technical services, information technology

services, cultural creativity services, logistical ancillary services, attestation

consulting services, radio, film and television services, commercial support 6

services and other modern services), lifestyle services, sale of intangible

assets such as technologies, trademarks, copyrights, goodwill, rights to use

natural resources (excluding land use rights) and other equity intangible assets�

• Any cross-border taxable activity conducted by an entity or individual within 0

the territory�

Consumption Tax

• “Luxury goods” (tobacco, wines, cosmetics etc�, depends on the good)� 1–56

• Resource-intensive goods

ADMINISTRATION AND REGULATIONS

a) Tax year

The tax year is the calendar year� Tax quarters and tax months are calendar quarters and calendar months,

respectively�

Doing Business in China 2023 | 23