Page 27 - Doing Business in China

P. 27

TAXATION

If the turnover of a company exceeds the threshold, it is mandatory to apply for general VAT taxpayer status�

However, companies below this threshold may also apply for recognition as a general VAT taxpayer (subject

to approval by the supervising tax bureau)� Once a small-scale taxpayer is recognised as a general taxpayer,

the small-scale taxpayer status no longer applies even if its sales fall below the threshold in the future� [Note:

General taxpayer status must be granted by the tax authority�]

Small-scale VAT taxpayers

The annual taxable sales revenue threshold of a small-scale VAT payer shall be less than or equal to RMB5

million�

Small-scale VAT taxpayers who are able to provide sound and accurate accounting and tax-related information

can register with the appointed tax authorities to apply for general taxpayer status�

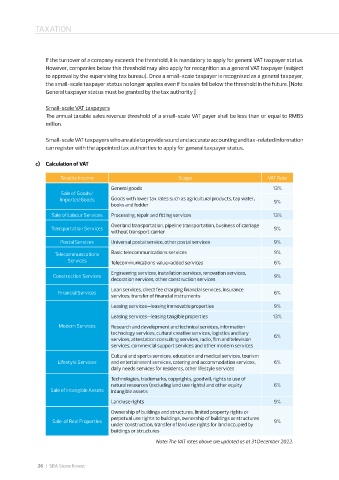

c) Calculation of VAT

Taxable Income Scope VAT Rate

General goods 13%

Sale of Goods/

Imported Goods Goods with lower tax rates such as agricultural products, tap water, 9%

books and fodder

Sale of Labour Services Processing, repair and fitting services 13%

Overland transportation, pipeline transportation, business of carriage

Transportation Services 9%

without transport carrier

Postal Services Universal postal service, other postal services 9%

Telecommunications Basic telecommunications services 9%

Services Telecommunications value-added services 6%

Engineering services, installation services, renovation services,

Construction Services 9%

decoration services, other construction services

Loan services, direct fee charging financial services, insurance

Financial Services 6%

services, transfer of financial instruments

Leasing services—leasing immovable properties 9%

Leasing services—leasing tangible properties 13%

Modern Services Research and development and technical services, information

technology services, cultural creative services, logistics ancillary

services, attestation consulting services, radio, film and television 6%

services, commercial support services and other modern services

Cultural and sports services, education and medical services, tourism

Lifestyle Services and entertainment services, catering and accommodation services, 6%

daily needs services for residents, other lifestyle services

Technologies, trademarks, copyrights, goodwill, rights to use of

natural resources (excluding land use rights) and other equity 6%

Sale of Intangible Assets intangible assets

Land use rights 9%

Ownership of buildings and structures, limited property rights or

perpetual use rights to buildings, ownership of buildings or structures

Sale of Real Properties 9%

under construction, transfer of land use rights for land occupied by

buildings or structures

Note: The VAT rates above are updated as at 31 December 2022.

26 | SBA Stone Forest

26