Page 29 - Doing Business in China

P. 29

TAXATION

CONSUMPTION TAX (CT)

Consumption tax applies to the production, processing and import of prescribed non-essential and luxury, and

resource-intensive goods, such as tobacco, alcoholic drinks, cosmetics, fuel, expensive watches, disposable

wooden chopsticks, yachts, golf, jewellery, car tyres, motorcycles and motor cars�

The tax is calculated based on the quantity or price of goods sold, or in certain cases, on a combination of both� For

example, the tax rate for gasoline is RMB 0�2 per litre and therefore based on quantity� On the other hand, the tax

rate for cigars is 40% of the selling price�

The proportional consumption tax rate ranges from 3% to 56% of revenue for the different types of goods�

Consumption tax paid on exports is fully refundable�

CUSTOMS DUTY

Import duties are levied at both general and preferential rates� The preferential rates apply to imports from countries

or regions that have signed agreements with China containing reciprocal preferential tariff clauses, while general

tariff rates apply to imports from all other jurisdictions� However, if special permission is granted by the State

Council Customs Tariff, preferential tariff rates may be applied to imports that would otherwise be subject to the

general rates�

To encourage foreign investment, foreign-invested companies that meet certain requirements may be exempted

from customs duties on imports of machinery and equipment for their own use�

a) Customs valuation

Import customs duties are levied based on the Cost Insurance Freight (CIF) value� Export customs duties are

calculated based on the Free on Board (FOB) price of goods less export duty�

b) Reduction and exemption

Customs duties are reduced or payers are exempted from them under the following conditions:

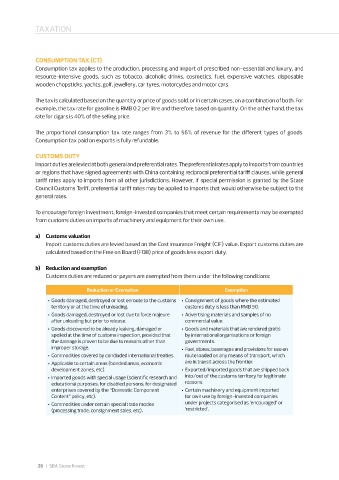

Reduction or Exemption Exemption

• Goods damaged, destroyed or lost enroute to the customs • Consignment of goods where the estimated

territory or at the time of unloading� customs duty is less than RMB 50�

• Goods damaged, destroyed or lost due to force majeure • Advertising materials and samples of no

after unloading but prior to release� commercial value�

• Goods discovered to be already leaking, damaged or • Goods and materials that are rendered gratis

spoiled at the time of customs inspection, provided that by international organisations or foreign

the damage is proven to be due to reasons other than governments�

improper storage� • Fuel, stores, beverages and provisions for use en

• Commodities covered by concluded international treaties� route loaded on any means of transport, which

• Applicable to certain areas (bonded areas, economic are in transit across the frontier�

development zones, etc)� • Exported/imported goods that are shipped back

• Imported goods with special usage (scientific research and into/out of the customs territory for legitimate

educational purposes, for disabled persons, for designated reasons�

enterprises covered by the “Domestic Component • Certain machinery and equipment imported

Content” policy, etc)� for own use by foreign-invested companies

• Commodities under certain special trade modes under projects categorised as ‘encouraged’ or

(processing trade, consignment sales, etc)� ‘restricted’�

28

28 | SBA Stone Forest