Page 34 - Doing Business in China

P. 34

TAXATION

In addition, individuals are required to keep records of income from all sources and report these annually to the

local tax authority by 30 June every year if they are in any of the following circumstances:

(1) The taxpayer receives general income in more than two places, and the balance of the annual general

income minus special deductions exceeds RMB 60,000;

(2) The taxpayer has one or more income sources for personal services, author’s remuneration and royalties,

and the balance of the annual general income minus special deductions exceeds RMB 60,000;

(3) The amount of tax paid in advance during the tax year is lower than the amount of tax payable;

(4) The taxpayer applies for a tax refund; or

(5) The taxpayer was originally a non-resident individual but subsequently meets resident individual

conditions due to extension of the residence duration to 183 days or more within a calendar year� If the

resident taxpayer is expected to leave China without returning in the same year of departure, he/she

must make a final tax settlement before leaving the country�

REAL ESTATE TAX

Real estate (property) tax is levied on an annual basis and payable on an instalment basis� The local tax authorities

will determine when the real estate taxes are payable�

An individual’s residential real estate is currently exempt from real estate tax unless it is rented out�

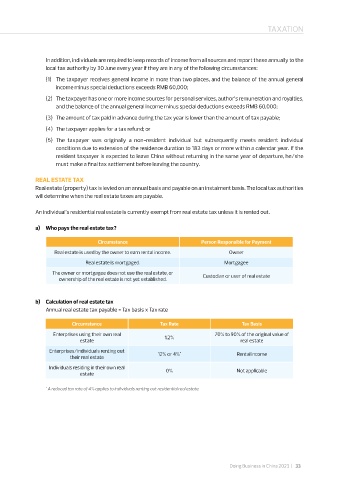

a) Who pays the real estate tax?

Circumstance Person Responsible for Payment

Real estate is used by the owner to earn rental income� Owner

Real estate is mortgaged� Mortgagee

The owner or mortgagee does not use the real estate, or

ownership of the real estate is not yet established� Custodian or user of real estate

b) Calculation of real estate tax

Annual real estate tax payable = Tax basis x Tax rate

Circumstance Tax Rate Tax Basis

Enterprises using their own real 1�2% 70% to 90% of the original value of

estate real estate

Enterprises/individuals renting out 12% or 4% * Rental income

their real estate

Individuals residing in their own real 0% Not applicable

estate

* A reduced tax rate of 4% applies to individuals renting out residential real estate.

Doing Business in China 2023 | 33