Page 37 - Doing Business in China

P. 37

TAXATION

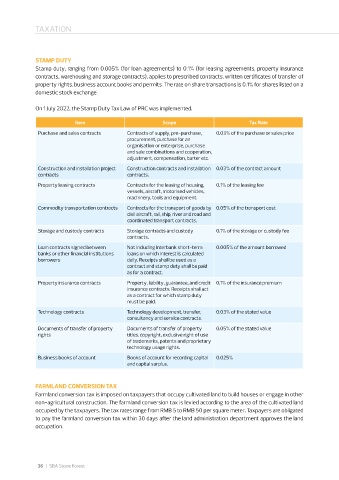

STAMP DUTY

Stamp duty, ranging from 0�005% (for loan agreements) to 0�1% (for leasing agreements, property insurance

contracts, warehousing and storage contracts), applies to prescribed contracts, written certificates of transfer of

property rights, business account books and permits� The rate on share transactions is 0�1% for shares listed on a

domestic stock exchange�

On 1 July 2022, the Stamp Duty Tax Law of PRC was implemented�

Item Scope Tax Rate

Purchase and sales contracts Contracts of supply, pre-purchase, 0�03% of the purchase or sales price

procurement, purchase for an

organisation or enterprise, purchase

and sale combinations and cooperation,

adjustment, compensation, barter etc�

Construction and installation project Construction contracts and installation 0�03% of the contract amount

contracts contracts�

Property leasing contracts Contracts for the leasing of housing, 0�1% of the leasing fee

vessels, aircraft, motorised vehicles,

machinery, tools and equipment�

Commodity transportation contracts Contracts for the transport of goods by 0�05% of the transport cost

civil aircraft, rail, ship, river and road and

coordinated transport contracts�

Storage and custody contracts Storage contracts and custody 0�1% of the storage or custody fee

contracts�

Loan contracts signed between Not including interbank short-term 0�005% of the amount borrowed

banks or other financial institutions loans on which interest is calculated

borrowers daily� Receipts shall be used as a

contract and stamp duty shall be paid

as for a contract�

Property insurance contracts Property, liability, guarantee, and credit 0�1% of the insurance premium

insurance contracts� Receipts shall act

as a contract for which stamp duty

must be paid�

Technology contracts Technology development, transfer, 0�03% of the stated value

consultancy and service contracts�

Documents of transfer of property Documents of transfer of property 0�05% of the stated value

rights titles, copyright, exclusive right of use

of trademarks, patents and proprietary

technology usage rights�

Business books of account Books of account for recording capital 0�025%

and capital surplus�

FARMLAND CONVERSION TAX

Farmland conversion tax is imposed on taxpayers that occupy cultivated land to build houses or engage in other

non-agricultural construction� The farmland conversion tax is levied according to the area of the cultivated land

occupied by the taxpayers� The tax rates range from RMB 5 to RMB 50 per square meter� Taxpayers are obligated

to pay the farmland conversion tax within 30 days after the land administration department approves the land

occupation�

36 | SBA Stone Forest

36