Page 39 - Doing Business in China

P. 39

TAXATION

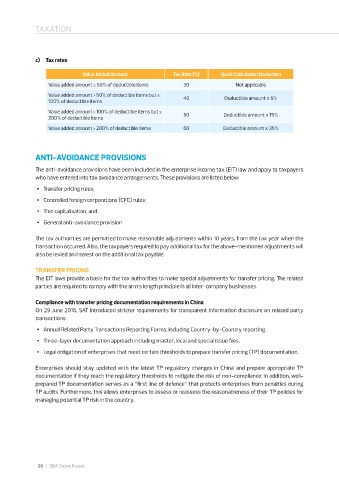

c) Tax rates

Value Added Amount Tax Rate (%) Quick Calculation Deduction

Value added amount ≤ 50% of deductible items 30 Not applicable

Value added amount > 50% of deductible items but ≤

100% of deductible items 40 Deductible amount x 5%

Value added amount > 100% of deductible items but ≤

200% of deductible items 50 Deductible amount x 15%

Value added amount > 200% of deductible items 60 Deductible amount x 35%

ANTI-AVOIDANCE PROVISIONS

The anti-avoidance provisions have been included in the enterprise income tax (EIT) law and apply to taxpayers

who have entered into tax avoidance arrangements� These provisions are listed below:

▪ Transfer pricing rules;

▪ Controlled foreign corporations (CFC) rules;

▪ Thin capitalisation; and

▪ General anti-avoidance provision

The tax authorities are permitted to make reasonable adjustments within 10 years, from the tax year when the

transaction occurred� Also, the taxpayers required to pay additional tax for the above-mentioned adjustments will

also be levied an interest on the additional tax payable�

TRANSFER PRICING

The EIT laws provide a basis for the tax authorities to make special adjustments for transfer pricing� The related

parties are required to comply with the arm’s length principle in all inter-company businesses�

Compliance with transfer pricing documentation requirements in China

On 29 June 2016, SAT introduced stricter requirements for transparent information disclosure on related party

transactions:

▪ Annual Related Party Transactions Reporting Forms, including Country-by-Country reporting�

▪ Three-layer documentation approach including master, local and special issue files�

▪ Legal obligation of enterprises that meet certain thresholds to prepare transfer pricing (TP) documentation�

Enterprises should stay updated with the latest TP regulatory changes in China and prepare appropriate TP

documentation if they reach the regulatory thresholds to mitigate the risk of non-compliance� In addition, well-

prepared TP documentation serves as a “first line of defence” that protects enterprises from penalties during

TP audits� Furthermore, this allows enterprises to assess or reassess the reasonableness of their TP policies for

managing potential TP risk in the country�

38 | SBA Stone Forest

38