Page 59 - Doing Business in China

P. 59

ACCOUNTING

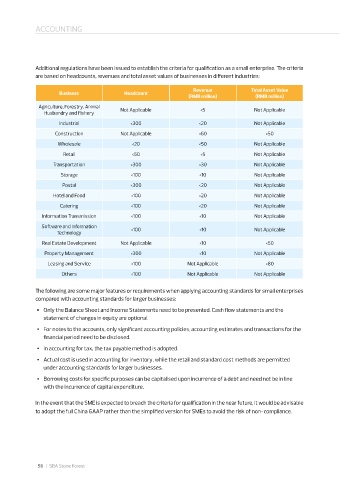

Additional regulations have been issued to establish the criteria for qualification as a small enterprise� The criteria

are based on headcounts, revenues and total asset values of businesses in different industries:

Revenue Total Asset Value

Business Headcount

(RMB million) (RMB million)

Agriculture, Forestry, Animal

Husbandry and Fishery Not Applicable <5 Not Applicable

Industrial <300 <20 Not Applicable

Construction Not Applicable <60 <50

Wholesale <20 <50 Not Applicable

Retail <50 <5 Not Applicable

Transportation <300 <30 Not Applicable

Storage <100 <10 Not Applicable

Postal <300 <20 Not Applicable

Hotel and Food <100 <20 Not Applicable

Catering <100 <20 Not Applicable

Information Transmission <100 <10 Not Applicable

Software and Information

Technology <100 <10 Not Applicable

Real Estate Development Not Applicable <10 <50

Property Management <300 <10 Not Applicable

Leasing and Service <100 Not Applicable <80

Others <100 Not Applicable Not Applicable

The following are some major features or requirements when applying accounting standards for small enterprises

compared with accounting standards for larger businesses:

▪ Only the Balance Sheet and Income Statements need to be presented� Cash flow statements and the

statement of changes in equity are optional�

▪ For notes to the accounts, only significant accounting policies, accounting estimates and transactions for the

financial period need to be disclosed�

▪ In accounting for tax, the tax payable method is adopted�

▪ Actual cost is used in accounting for inventory, while the retail and standard cost methods are permitted

under accounting standards for larger businesses�

▪ Borrowing costs for specific purposes can be capitalised upon incurrence of a debt and need not be in line

with the incurrence of capital expenditure�

In the event that the SME is expected to breach the criteria for qualification in the near future, it would be advisable

to adopt the full China GAAP rather than the simplified version for SMEs to avoid the risk of non-compliance�

58 | SBA Stone Forest

58