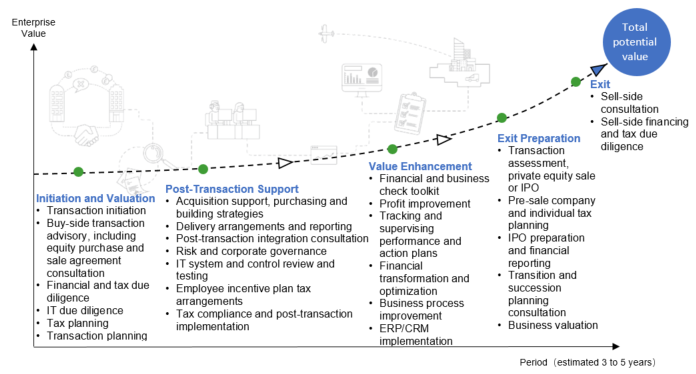

Focusing on the Full Lifecycle of Private Equity Investment

We support you through the entire life cycle of your investments Your Investment Cycle

- Deal origination

- Buy-side transaction advisory, including SPA advisory

- Due diligence – Financial, tax & IT

- Tax structuring

Post-Close

- Post-close integration advisory

- Completion accounts

- Governance & risk assessment reviews

- Value enhancement & performance improvement

- IT system & control review & testing

- Tax compliance and post-close review

- Business grooming & exit review

- IPO advisory

- Business valuation

- Vendor financial & tax due diligence

- Sell-side advisory

We help you with compliance needs at both fund manager and fund levels

- Internal audit

- Regulatory compliance advisory

- Risk management & governance

- Technical risk management

- Compliance outsourcing

- Portfolio valuation support

- Tax compliance

- Tax structuring

- Goods & services tax consulting

- Transfer pricing

- Company secretarial services

- Accounting & financial reporting

- Payroll outsourcing

- Executive search & staff placement services

- IT outsourcing & managed services

- CFO support services

We help optimise the value of your portfolio companies

Advisory

- Financial and business review toolkit

- Roadmap for profit improvement

- Tracking and monitoring of performance and action plans

- Business process improvement

- IT & cyber security advisory

- Internal audit

- Enterprise risk management

- Development of policies & procedures

- Valuation support

- Corporate restructuring

- Transition and succession advisory

Tax

- Tax structuring & advisory

- Tax compliance

- Transfer pricing

Business solutions

- Company secretarial services

- Accounting & financial reporting

- Payroll outsourcing

- Executive search & staff placement services

- IT outsourcing & management services

- CFO support services

Why SBA Stone Forest?

- Deep understanding of the deal-making community

- Mid-market focus – every transaction is crucial to us

- Comprehensive range of services tailored for our private equity clients

- Supported by over 40 partners and 1200+ team members delivering professional, hands-on services

- Global reach with local perspectives